Inflating

Have we reached peak inflation?

Well, if you thought peak inflation had been reached, the May U.S. Consumer Price Index certainly did not show that to be the case. And the markets are not a fan. U.S. CPI rose 1.0% in May, which brought the one-year tally to +8.6%. One little silver lining is that core CPI (excluding Food and Energy) was 6.0%, which is down from last month’s pace of 6.2%, marking its second month of declines. But really it was hard to find good news with this inflation print. This has clearly pushed equities lower as the timing of central banks slowing their rate hike pace has certainly moved out later into the future.

And while this was a U.S. economic release, the impact has been global. In response, bond yields moved higher in the U.S., Canada, Europe, and elsewhere around the globe. The move is about 10-15bps at the time of writing, which has the U.S. 10-year at 3.17% and the Canada 10-year up even higher at 3.35%. Once again, that makes for a drop in equities and bonds, which is not something anyone likes. 10-year yields are now a decent amount over 3% and are at a pretty critical level.

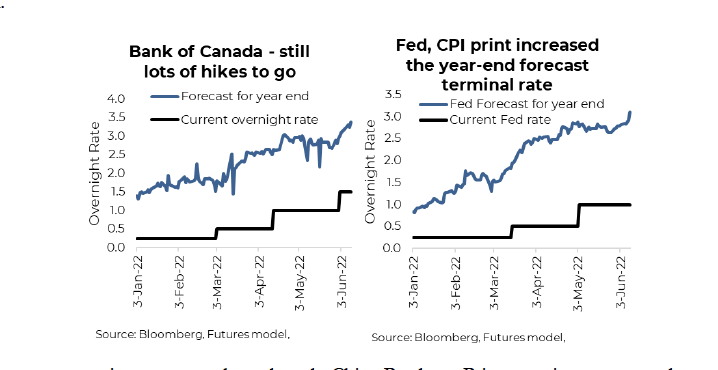

This has certainly opened the door for the Fed to not just go for two 50bps moves in the summer meetings; it could mean we see a bigger move or even keep the 50bps pace up longer. And after yesterday’s Bank of Canada Financial System review, it seems that the rate hike paces are unlikely to let up anytime soon. The futures market is now pricing in an overnight rate in Canada of 3.39%, compared with the current 1.5% level. The Fed futures really jumped on the CPI, with the year-end forecast at 3.1% compared with the current 1.0% level.

Investment Implications

We continue to believe the inflationary impulse will begin to fade later this year, but it certainly won’t be smooth. The economy works in waves and some waves move faster than others. Higher financing costs and financial conditions are now starting to slow economic activity. The wave or impact has a certain speed. The subsequent slowing of inflation is another wave that takes even longer, but we do believe it is still coming.

Given most portfolios tend to be much shorter duration than the overall bond market, we would continue to recommend taking advantage of the rising yields by adding some duration back into the portfolio. Not all at once, but in stages.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Greg Taylor and Derek Benedet Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used herein under a non-exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

Echelon Wealth Partners Ltd.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Ltd. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

CLIENT LOGIN

L.I.F.E. Wealth Management Inc.

Please note that only

Echelon Wealth Partners

is a member of CIPF and regulated by IIROC;

Chevron Wealth Preservation Inc. is not.

*Insurance Products provided through Chevron Preservation Inc.

Website Links